HOW MUCH CAN I MAKE?

To answer that question, there are several important things to consider.

ONE: The price you purchase at

TWO: Time frame for investment

THREE: Past, proven, historical gains

FOUR: Protect the downside

1. PRICES

“I think the price is not that cheap”

No its not. Sydney is an expensive city. BUT, consider this:

-Sydney is ranked 3 in the world for the most liveable cities in 2019 by the Economist Intelligence Units list of the Wolds most liveable cities

-Shortage of land. Sydney has used up all available land for development within 2 hour's drive of the city

-Rising population. Sydney and Melbourne attract more migrants than any other cities in Australia. Migration is not going away, and there will be an enormous SURGE in demand and population after Covid

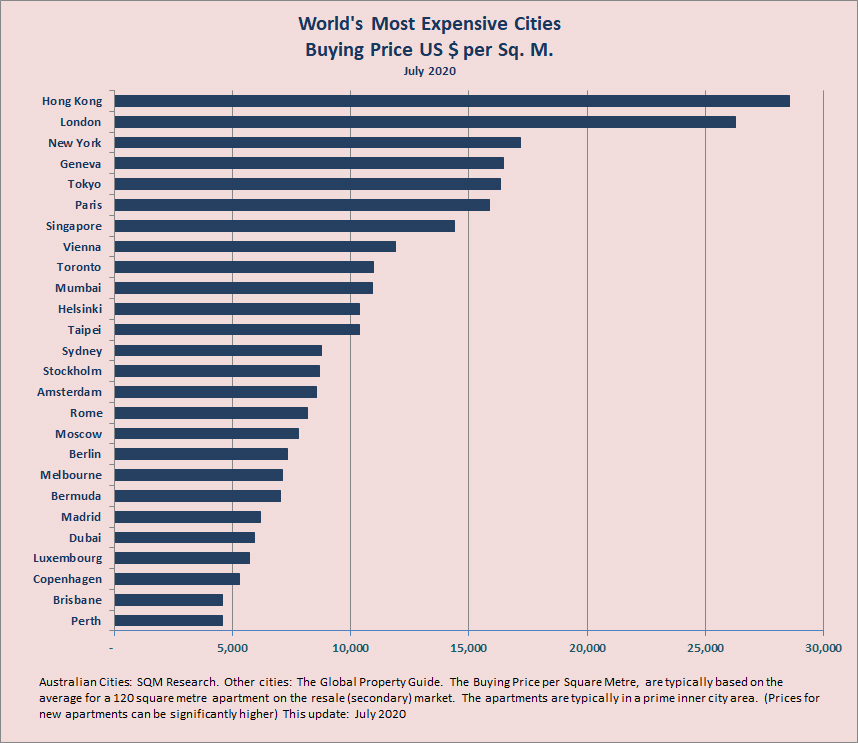

-Sydney's prices are very affordable still on a world scale

2. TIME FRAME FOR INVESTMENT

With this location, with this quality, at these prices, then you’d have to think that over the next 5-7 years, you can see a potentially really strong return. There’s actually no reason to believe anything else. Sydney's long term trend line is UP, and this price will not ever be available in the future.

These apartments are being offered at TODAY’S price, in ONE OF THE world's most liveable cities.

.jpg?timestamp=1607839656730)

If you look at the long term trend line above, you can clearly see that EVERY TIME the price index has fallen below the trend line, it shoots up. And when it gets well above the trend line, it falls back. Based on this alone, we could expect Sydney to have a shard rise in prices in 2021 to 2023. The time to act is now.

3. HOW MUCH COULD IT GO UP?

If you decide to secure an apartment, and the next 15 years is the same as the last 15 years, you will get over 360% return on your investment, in just 15 years!*

While no one can predict the future of course, the past is often a guide as to what is likely to happen in the future.

4. THE DOWNSIDE

After you do secure an apartment for some reason the market only performs HALF as well over the next 15 YEARS as it has done in the past 15 years, you’ll still make over 170% return on your own capital in 15 years. Still not too shabby!

Compared to no interest in cash deposits left in the bank.

The downside is well protected because you are buying in at the right time in the property cycle. In a great location, at a great price.

There is also strong upside potential, and in fact based on all indicators, it would seem likely the next 15 years should be at least as good if not better than the past 15 years.

.jpg?timestamp=1607839928836)

Sydney has continually risen, through all economic and historical events.

-------------------------------------------------------------------------------------

According to Michael Bentley, author of “The Foreign Investors guide to Australian Property” and Managing Director at Citylife International:

"First, always buy in a GREAT location, even if it costs a bit more. Second, be PATIENT! Buy for the long term to reap the benefits.

Third, buy from trustworthy people and companies, who are with you all the way" he says.

*According to the Australian Bureau of Statistics the average property price in Sydney has risen between September 2005 to September 2020 (15 years) by 108%.

Therefore a $485,000 apartment secured on 30% deposit in 2005, is now worth say $1,000,000.

Return is $1,000,000

less 70% loan: $340,000

-------------------

$660,000

on $146,000 initial investment.

Your ROI (Return on Investment) is therefore 352%.

<$146,000 investment turns into $660,000>**

**All figures rounded for simplicity. Does not include rental return, outgoings or loan repayments or other costs on sale and purchase. For illustration purposes, the past does not guarantee the future.