THE AUSTRALIAN - AUGUST 2021

A: Naturally, in order to appeal to a specific section of the property market (i.e. those who wish to rent rather than buy), developers are custom designing BTR sites to suit prospective renter’s lifestyles. Obviously, the properties themselves need to meet modern standards of living, and plenty actually exceed expectations if you’re willing and able to pay the rent they command, but BTR developments in many areas are going one step further than merely designing fantastic apartments.

Developers are now creating, or at least trying to create, mini communities within their developments by including features such as communal areas where people can hang out and socialise together. Such features include the obvious and not-so obvious, from gyms to lounges and games rooms to dining spaces. In fact, many BTR developments are actually closer to hotels than homes.

.jpg?timestamp=1631185044339)

Tenants will even have their own concierge in some. And the latest technology. And cleaning and laundry services.

Build-to-Rent aims to take the best aspects of Single Family Residences and apartments, and upgrade the experience by developing all properties inside a professionally managed community.

They are much more akin to traditional, gated residential neighborhoods with great community amenities and professional management without burdening residents with Rates and Charges, Body Corporate Fees, Land Taxes and repairs. Or servicing mortgage debt.

Owners can not arrive and evict the tenant. The tenant can sign up for one month or 5 years.

The new buildings will be Covid prepared, self check in and arrival, and much more.

A: "As with any housing project, location is vitally important. And, as build to rent is a service-driven housing solution, the audience for the scheme is crucial.

BTR can offer housing in connected locations that would otherwise be unaffordable to commuters, but the location needs to be right to support the density and sustain the community.

Due to the financial firepower behind BTR, developers have been able to unlock high-value sites in urban areas that for-sale developers would have struggled with"

(Russell Pedley, co-founder and director of award-winning BTR market leader Assael Architecture, and co-author of the Urban Land Institute’s Build to Rent: A Best Practice Guide, UK, sponsored by the UK Government)

A: "Shift some the amenity space from private to shared use. There are primary shared amenities that every BTR project should have (mail delivery, lounge area, back of house for storage, loading bay for move in and move out, refuse collection facilities) and there are secondary amenities to reflect the brand. Since BTR buildings are typically institutionally backed and owner-operated, the building has to perform as an asset for both the investors and residents.

This means that facilities such as gyms and swimming pools must be continuously assessed both in terms of what they add to the community and their operational costs. Fostering a sense of community within a BTR development is essential, as it leads to higher retention rates that contribute positively to the financial performance of the development. When people love where and who they live next to, they stick around!" (Russell Pedley)

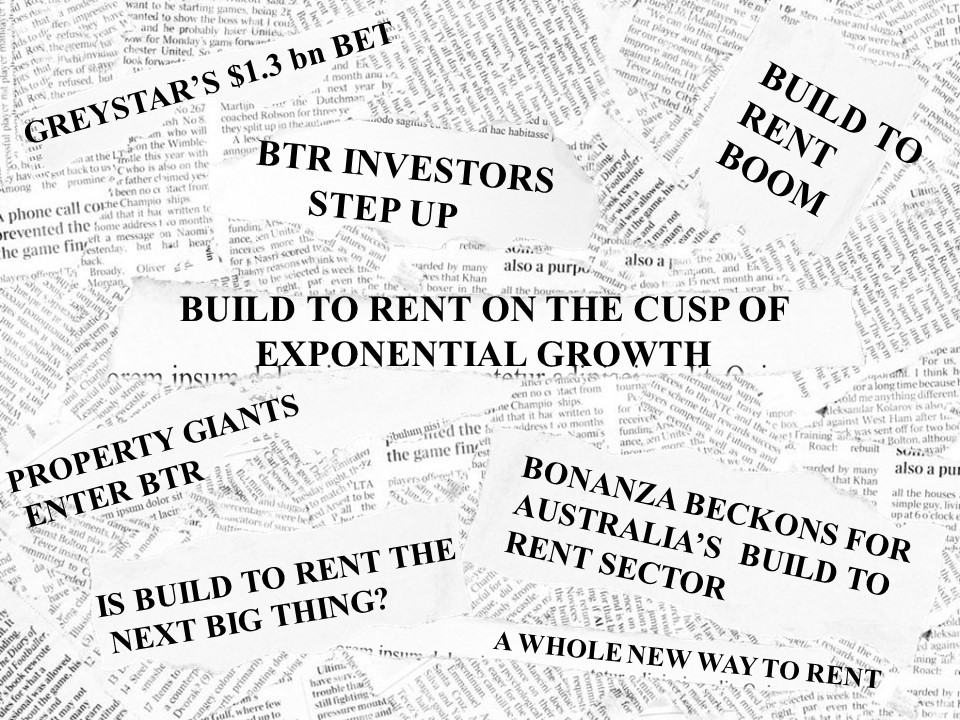

Experts predict a build-to-rent (BTR) revolution coming to Australia

To invest in Build to Rent property, there are only a limited number of opportunities for individual investors to go down.

So in saying that you can invest in shares of a BTR developer. Some investors have made the mistake of investing themselves in student housing or buying serviced apartments, thinking this perhaps was Build to Rent.

Far from it! These investments have mostly been very unsuccessful for individuals in terms of capital growth, although very lucrative for developers.

Build to Rent investors opportunities are generally only open to accredited investors, in joint venture or syndications with private property developers.

Income last two years of AU$250K for each year

or:

Net assets of AU$2.5M

or:

Gross assets of AU$10M (Have or control)

or:

Assessed by a licensee as having previous experience in using financial services and investing in financial products.

or:

Investors placing AU$500,000 or more in a single investment usually automatically qualify as an accredited investor and no further requirements need be met.

In preparing this website Citylife International Realty Limited ("The Company") has relied upon information provided by the various partners and information that is publicly available. This website is for the sole purpose of assisting potential investors ("Prospective Investors") in relation to understanding the investment opportunity in Australia, and the background of The Company. The material on this website has been prepared for informational purposes only should in no event be construed as a solicitation or offer; as investment, legal, tax or other advice; or as a recommendation to buy, sell or engage in any transaction whatsoever. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees and expenses.

(c) Copyright Citylife International Realty. Privacy Policy and Terms of Use