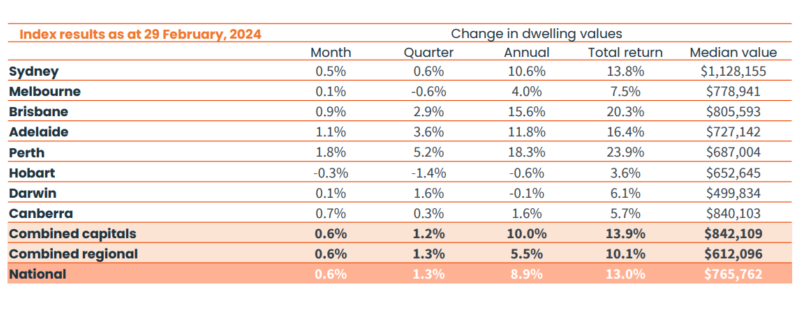

Change in "dwelling prices" (Units AND Houses combined) over past 12 months to 28 February 2024:

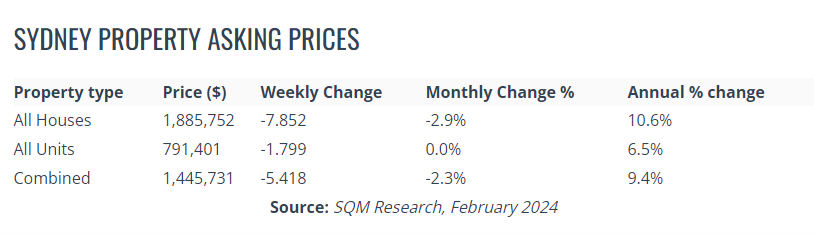

And here the current (Feb. 2024) "Asking Prices" that sellers are currently looking for. “Asking Prices” can be useful as these are a good leading indicator because they reflect the sentiment of sellers and the expectations for the future value of their properties:

1/2/24: Predictors of Australian Housing Market in 2024:

Drivers of Property Price Growth:

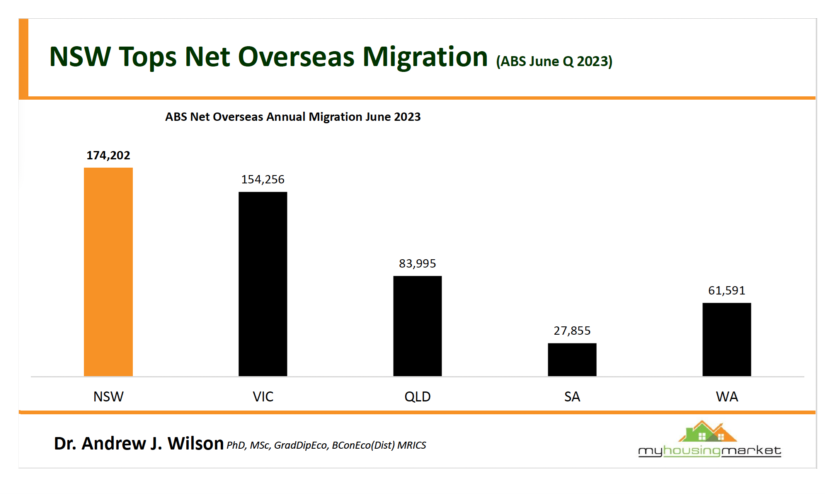

- Continued Population Growth: Strong population growth without sufficient new dwelling supply, leading to an extreme shortfall, putting upward pressure on house prices and rents. Sydney still tops the city attracting most overseas migrants.

- Anticipated Interest Rate Decline: Expectation of interest rates falling in the second half of 2024, coupled with potential relaxation of APRA's mortgage serviceability buffer (currently at 3%), increasing borrowing capacity.

- FOMO Effect: Fear of missing out as buyers realise recovery from 2022 price falls, with media highlighting new record prices achieved.

Challenges and Headwinds:

- Affordability Concerns: Stretched affordability, prompting buyers to opt for townhouses or apartments over homes, or choose more affordable suburbs.

- Unemployment Goals: The Reserve Bank of Australia (RBA) aiming to increase unemployment to curb inflation, creating financial uncertainty and impacting buyer decisions.

- Consumer Sentiment: Lingering poor consumer sentiment from 2023, driven by economic uncertainty, peaking interest rates, and inflation concerns, likely to persist in the first half of 2024.

Market Trends:

- Differential in Property Types: Recent trends show houses outpacing apartments in value. The price gap between units and houses is at a record high. Family-friendly apartments in desirable neighborhoods are expected to experience strong capital growth.

SYDNEY

While property price growth is expected to be lower in 2024 compared to last year, there is a positive aspect: you have the opportunity to outperform the national market by strategically investing in the right property and location. By this, I don't mean simply targeting the next hotspot. Instead, focus on acquiring high-quality properties in areas with long-term potential, such as gentrifying suburbs.

Property investment provides numerous chances to enhance your outcomes through your time, skills, and knowledge, allowing you to surpass average returns. It's not just about location; you can also increase property value through refurbishment or redevelopment.

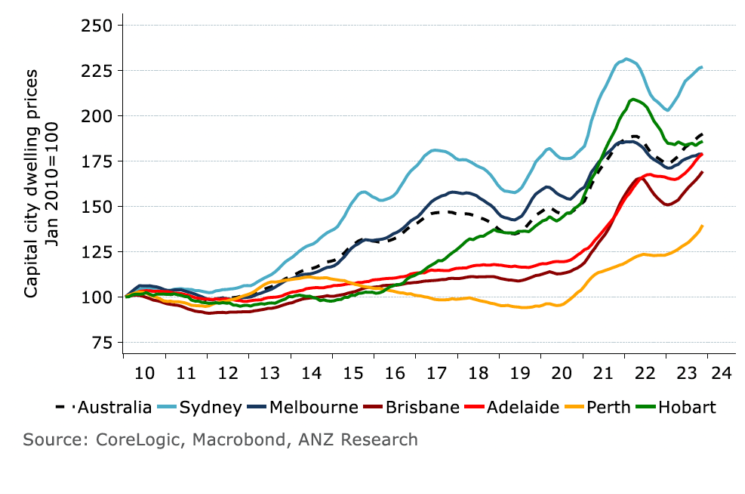

After booming through 2020 and 2021 with prices rising by 27.2%, Sydney housing values fell -12.4% from their peak in January 2022 through to the recent trough in January 2023.

But the Sydney housing market clearly turned the corner in early 2023 with prices rising consistently - now up 11.1% since January 2023.

And there are firm indications that Sydney property values and rents will keep rising strongly in 2024.

Currently, there are 5.2 million people in Sydney. By mid-century Sydney will have 8 million people and NSW will have 10 million inhabitants.

Sydney has a unique lifestyle and economic benefits that will attract overseas migrants as well as plentiful jobs for highly paid knowledge workers.

And Sydney was the first Australian capital city to embrace apartment living more than 30 years ago, with the most recent Census showing that 20.7% of all the dwellings in Sydney being apartments and in fact 47% of all the apartments in Australia are in Sydney

Currently affordability constraints, including consecutive cash rate hikes and reduced borrowing capacity, combined with the perceived value units offer are all helping to steer buyer demand towards units (apartments).

This is creating a window of opportunity for homebuyers and property investors with a long-term perspective.

And when interest rates start to reverse buyers will come back into the Sydney market with a vengeance. The time to position your self is before that happens.

The market is not easily explained. So if you are interested in either Buying or Selling in Sydney, feel free to schedule a no obligation call for 45 minutes where we can go through in detail the market. Remember, I don't SELL houses (or apartments!) so there is no hidden agenda.

I provide advisory services to certain types of buyers and sellers, and am always happy to discuss the market with ANYONE as my business is very selective, doesn't suit most people, but relies on referrals from people just like you who I have helped without any obligation or commitment.

And it's not just for houses…

Well-located, family-friendly apartments in Sydney's inner suburbs are likely to continue to perform strongly due to increasing demand from owner-occupiers (particularly First Home Buyers) and investors.

And at the same time, average or poor quality apartments in high-rise towers will continue to languish.

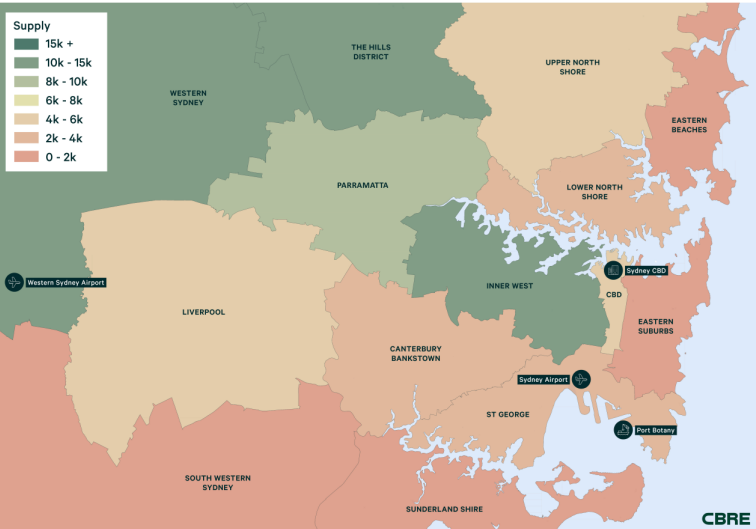

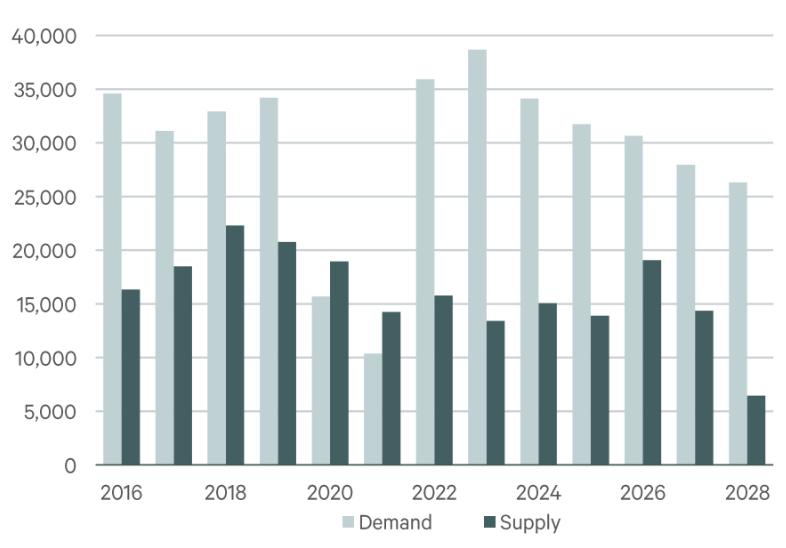

APARTMENT SUPPLY AND HEAT MAP 2016-2028:

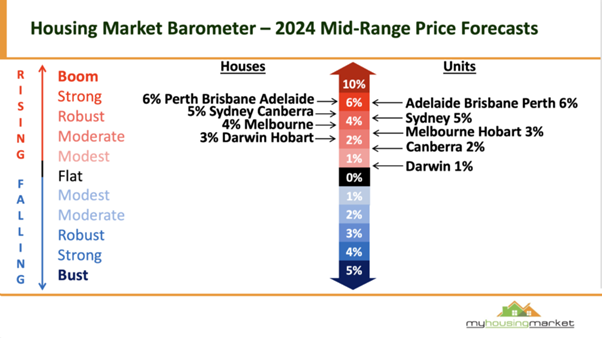

Here's what the major Australian banks are forecasting for property prices in Sydney in 2024:

- ANZ forecasts capital city property prices to lift 6 per cent. Sydney is tipped to life 6-7 per cent.

- CBA expects capital city prices to lift 5 per cent, with small variations across the cities. Sydney is at a 4 per cent rise.

- NAB predicts prices across the capitals to rise an average of 5.4 per cent. Prices are expected to lift 5 per cent in Sydney.

- WESTPAC forecasts 6 per cent growth across the combined capitals. Sydney is pencilled in for 6% growth.

-

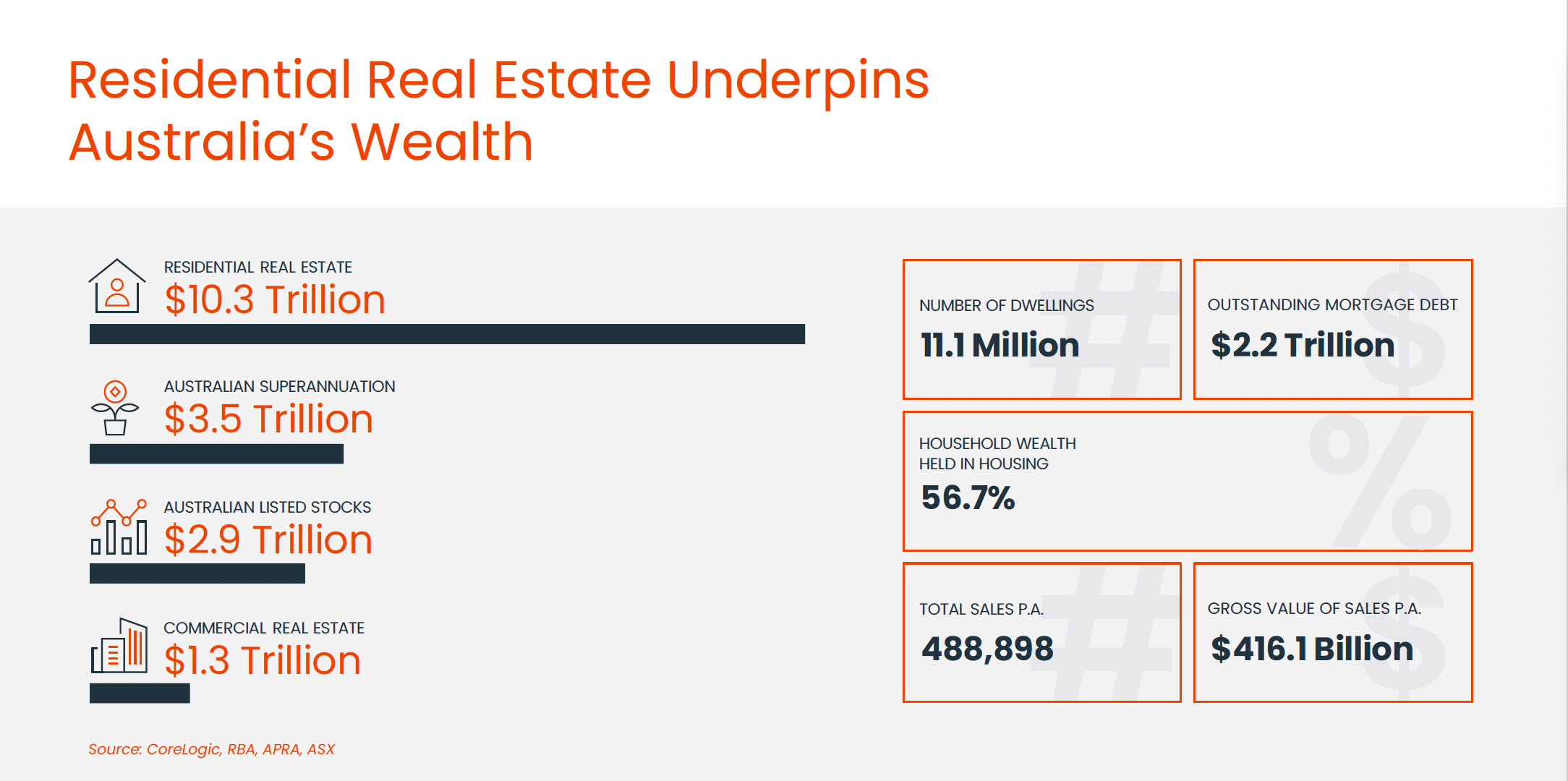

Apart from Location – Location – Location, is there ANOTHER Golden Rule of Property Investing in Australia?

YES there is. It is the QUALITY of your property that is of major importance to it’s financial success going forward 2024 to 2028.

KEY POINTS

- The quality of the property determines long-term investment returns.

- Average-quality property yields average returns; above-average quality leads to above-average returns.

- Combined with strategic locations near the water, city hubs, parks, shops, schools and supermarkets, helps ensure investment success. Wherever possible, focus in inner and middle ring properties ONLY.

- Focused Investment Energy:

- Direct energy towards asset quality working with your professional property buyers agent.

- Outsource all other matters (tax, borrowing, property management, building inspections etc.) to advisors.

- Attributes of Quality Property:

- Sustained buyer demand exceeding supply.

- Appreciating value/prices in the long run.

- High-quality property is scarce.

- Factors Impacting Supply and Demand:

- In prime investment locations, supply is fixed or diminishing.

- Supply includes land supply and dwelling type/style.

- Land Supply Dynamics:

- Well-established, blue-chip suburbs have fixed and finite land supply.

- Outer suburbs may have abundant land supply due to releases within a 20km radius.

- Property Type and Style Effect on Supply:

- High-land-value locations see stable house supply; apartments can change more readily.

- Example: Victorian style houses have finite supply, potentially diminishing.

- Buyer Demand Exceeding Supply:

- Buyer demand refers to potential buyers desiring property in a certain location.

- Demand substantially exceeding supply leads to rising property prices.

- Imbalance in Supply and Demand:

- Invest where buyer demand substantially exceeds supply.

- Notionally, 10 buyers for every seller ensures price stability despite changes in supply or demand.

- Long-Term Price Support:

- Despite changes, the number of buyers exceeds sellers, supporting prices.

- Prices remain resilient even during supply increases or demand reductions.

Tips:

Location Matters:

Look for properties in inner and middle-ring suburbs. Sydney's oldest real estate "rule" is still true today.

Proximity to City Center:

Suburbs close to the city center tend to perform better over the long term.

Value Appreciation Factors:

Properties closer to the CBD, harbour and beaches will experience faster value appreciation.

Supported by research from the Australian Housing and Urban Research Institute.

Research Confirmation:

Research confirms that suburbs near the CBD, with high demand, employment opportunities, and limited available land, outperform outer suburbs.

Gentrification Impact:

Gentrification has significantly influenced property values in inner- and middle-ring suburbs.

Demographic Shifts:

Gentrification resulted from demographic changes, not deliberate planning policies.

Exodus of industry, migrants, and workers paved the way for gentrification in inner suburbs.

Changing Demographics:

Changing demographics, including declining household size, contributed to the appeal of small inner suburban dwellings.

Ideal accommodation for professionals working in or near the CBD.

Attractions for Gentrifiers:

Gentrifiers initially attracted by job diversity, educational opportunities, and lifestyles in inner suburbs.

Trend continues as Australians increasingly opt for urban living over traditional suburban homes.

FINAL WORDS / CONCLUSION

NEGATIVE REAL INTEREST RATES

Despite the rises in interest rates over 2022 and 2023, Australia still has negative real interest rates.

That is inflation is higher than cash rate interest (before tax) so it is inevitable that those sitting on cash - losing money in real terms daily - would look to the property market.

Meanwhile, mortgage debt to GDP has been falling because of higher inflation. The bears hate this, because it means in effect the Australian housing market is not as geared as it once was.

MONEY SUPPLY

The Reserve Bank has really pulled back its printing of money to low levels, which should help inflation in 2024.

REAL GDP

Slowed not yet negative. This is a risk, if Australia falls into recession. Nominal GDP seems to have a strong long term relationship to house prices. In 2022 the rise was 12%.

Watch the nominal GPD figures for a macro view on house prices.

HOUSE PRICES

The Sydney house market has been driven by huge increases in underlying demand. And while I have zero real data to a support a downturn, interest rates, inflation, external and internal migration, the GDP and unemployment will all play a part.

However, the top end of the market should be a standout performer, as will units in 2024.

To discuss the market, and see whether my Service For Buyers can assist YOU, let's chat!

I have access to off market properties, pocket listings, as well as all properties currently listed. I use research, data and extensive contacts with agents to get many properties before they are publicly advertised.

Those properties that are already on the market now, I use all my knowledge, skills, experience, data and research as well as know-how to help you secure a great buy, working against the seller and their agent.