AUSTRALIAN PROPERTY INVESTMENT TAX REPORT: EVERYTHING EXPLAINED, SIMPLY.

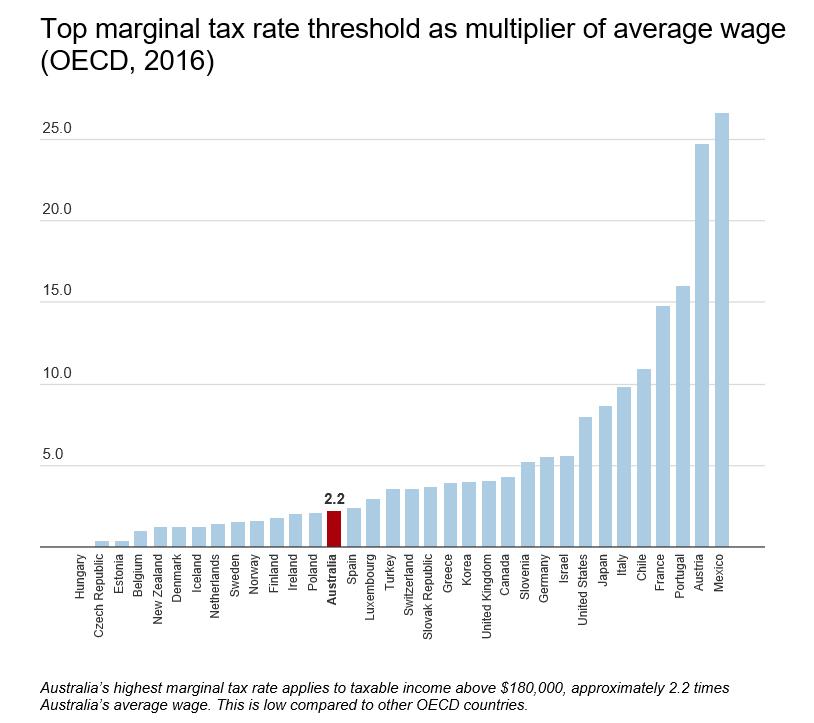

Many people think taxes are high in Australia and may not purchase property simply because of this.

This Special Free Report shows you the simple steps you can take, as well as the tax allowances you can claim, to lower, reduce and even eliminate completely all taxes on your Australian property investments.

You may be surprised at the real rates of tax you pay in Australia when investing in property.

Not too far off the rates in Singapore and Hong Kong.

Little known and understood, but true.

The Australian Government provides strong tax incentives for property investors.

Some expatriates living overseas are even worried about possible “world-wide” tax on their overseas income if they invest back home.

Again, a needless worry. Very few overseas investors - and expatriates- know the correct information, or even realise how the correct tax planning could benefit them hugely in the future by both reducing any potential income tax in Australia, tax on rental or Capital Gains (profits) tax.

What Tax do Non-Residents Pay? Capital Gains Tax explained. What is "negative gearing" and how does it work? And much more!

Order the Tax Report simply by registering below.